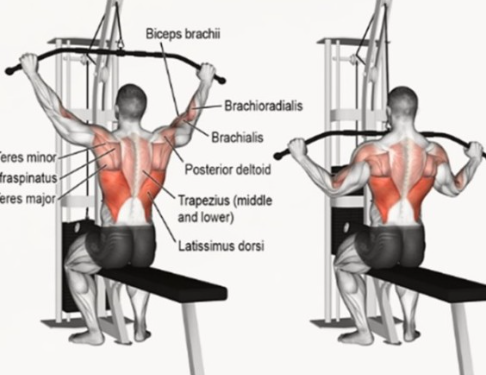

효과적인 어깨 운동으로 건강한 체형을 만들어보세요!

어깨는 우리 몸의 균형을 유지하는 데 중요한 부위 중 하나입니다. 올바른 어깨 운동은 우리의 체형을 개선하고 균형을 유지하는 데 도움이 됩니다. 이번 글에서는 효과적인 어깨 운동 방법과 주의할 점에 대해 알아보겠습니다. 1. 어깨 운동의 중요성 가. 균형 유지 강력한 어깨는 몸의 균형을 유지하는 데 중요합니다. 강력한 어깨 근육은 몸의 안정성을 제공하고 다른 운동을 수행할 때도 […]

계속 읽기